Enerplus Bakken purchase from Bruin

Enerplus acquired Bruin’s Willston Basin assets for US $465 million in cash. The deal included 151,000 net acres including 30,000 of land referred to as Tier 1 by Enerplus. McDaniel provided an independent reserve evaluation with 84 MMBOE of proved plus probable reserves and identifying 65 gross (50.0 net) proved plus probable undeveloped reserves locations. The aquisition closed in March 2021.

151,000 net acres

$580 million

84.1 MMBOE 2P Reserves

$24,000/Flowing BOE

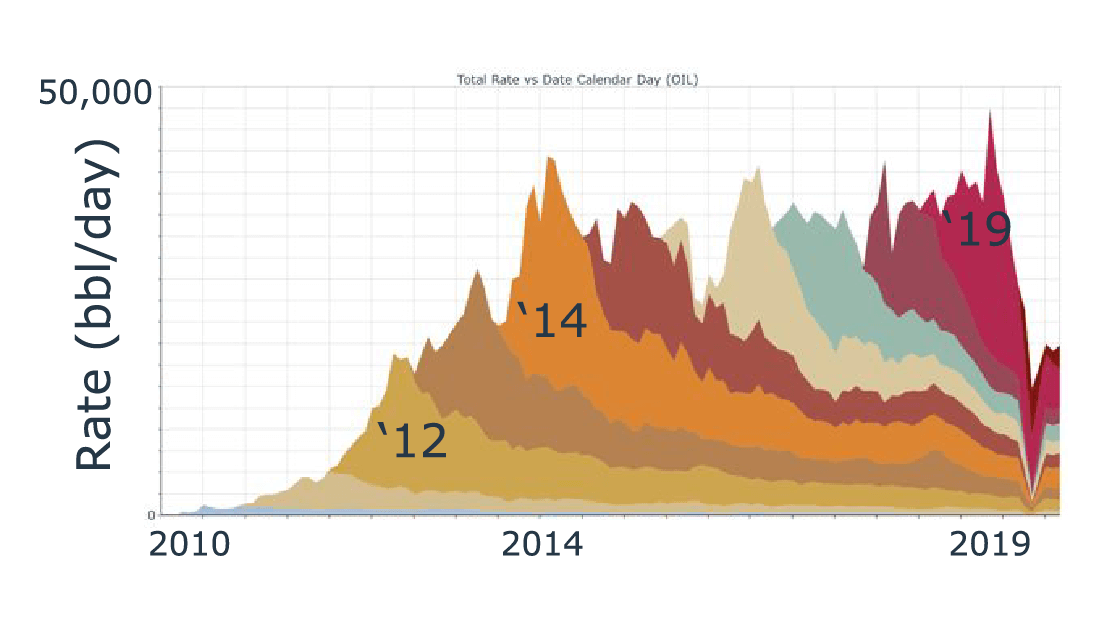

Bruin Historical Oil Production

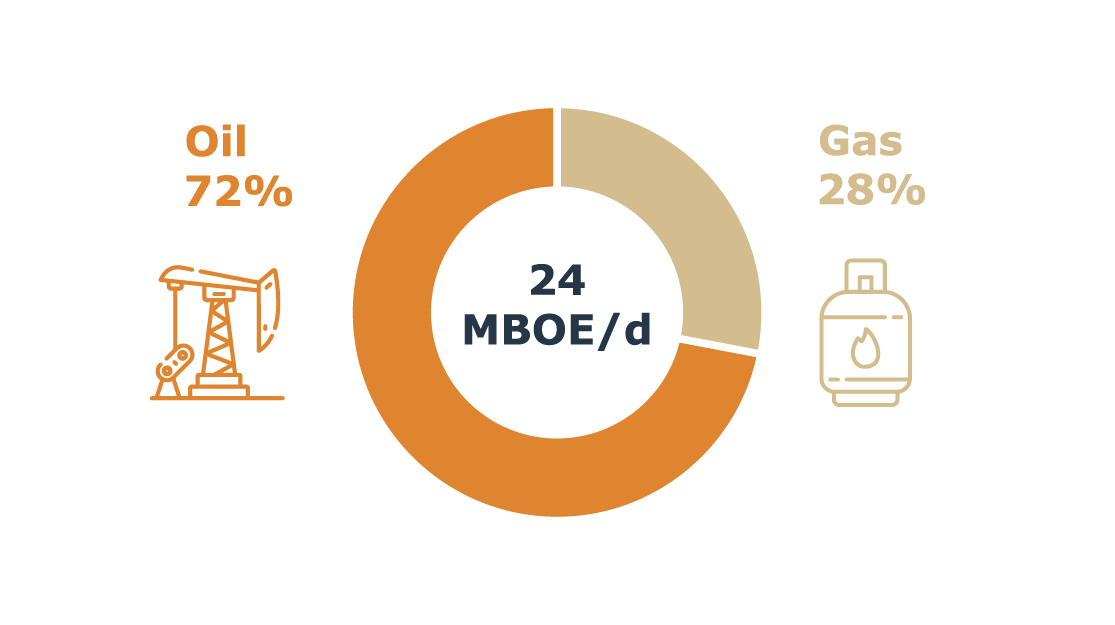

Composition

“This acquisition demonstrates our disciplined return-oriented focus and commitment to value creation for our shareholders. With immediately adjacent acreage offering strong operational synergies, Bruin’s assets are highly complementary to our existing tier 1 position in the Bakken and will enable us to accelerate free cash flow growth and further support our focus on providing long-term sustainable shareholder returns.”