Crescent Point Duvernay purchase

Crescent Point purchased Royal Dutch Shell’s Kaybob Duvernay Assets for $700 million cash and 50 million common shares. McDaniel & Associates prepared the independent evaluators report which included Proved plus Probable (“2P”) locations at a well spacing of 600 meters. These locations are primarily of two-mile horizontals. $12.87 per boe of 2P reserves of 107.4 MMboe were assigned, equating to a recycle ratio of over 2.0 times, including $483 million of undiscounted future development capital. The deal closed on April 1st, 2021.

450,000 net acres

$900 million

107.4 MMBOE 2P Reserves

$30,000/Flowing BOE

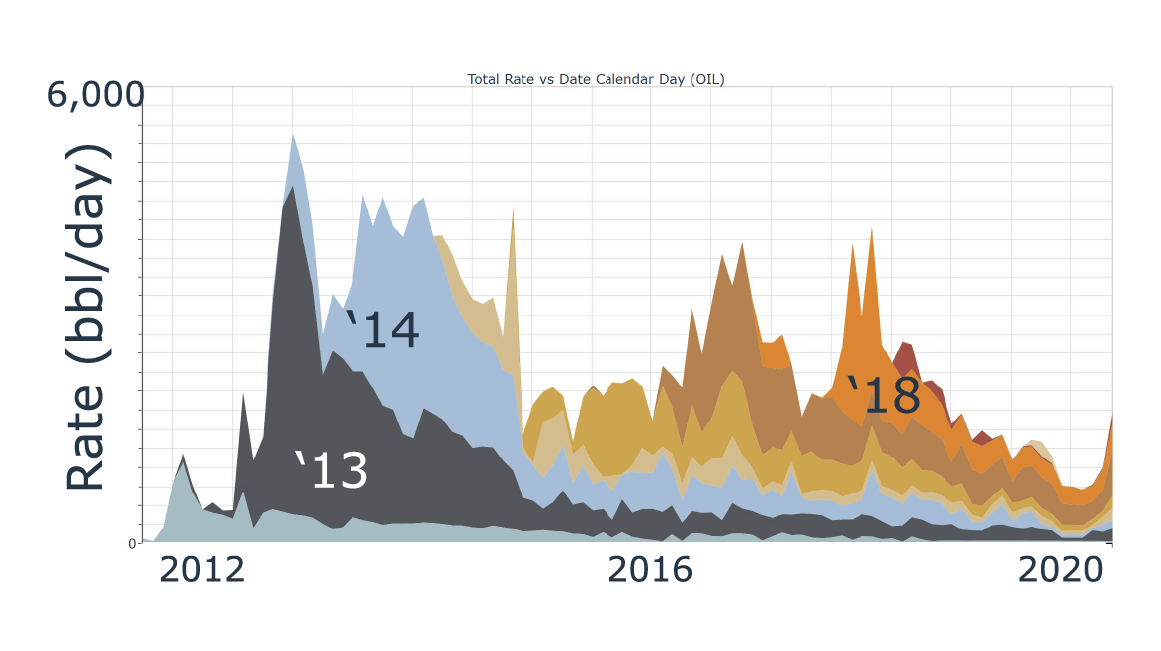

Shell Duvernay Oil Production

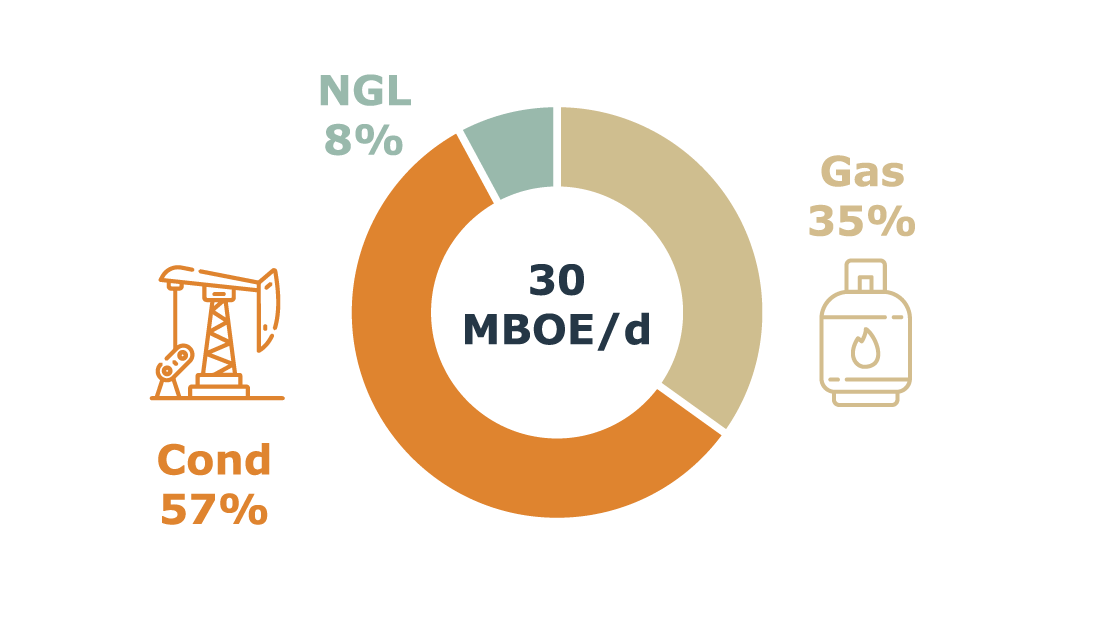

Composition

We are excited to add the Kaybob Duvernay asset as a strategic core area to our portfolio, as its significant inventory of high-return locations and free cash flow profile provide an attractive and return enhancing opportunity for our shareholders.